Extension of the JobKeeper Payment

The Government is extending the JobKeeper Payment by a further six months to March 2021. Support will be targeted to businesses and not-for-profits that continue to be significantly impacted by the Coronavirus.

The payment rate will be reduced, and a lower payment rate will be introduced for those who work fewer hours. Other eligibility rules remain unchanged.

ATO instructions for employers reporting via STP: https://www.ato.gov.au/general/jobkeeper-payment/In-detail/JobKeeper-guide---employers-reporting-through-STP/

STP reporting of tier level

Tier level is determined on hours worked per week in a reference period. For employees, the reference period is either the four weeks ending at the end of the most recent pay cycle before 1 March 2020, or before 1 July 2020. The ATO is also establishing alternative reference periods that can be used where the standard periods are not appropriate. The reference period is a historical period, so an employee’s tier will not change unless it was incorrectly determined.

Here is the guidelines from ATO on how to determine tier level: https://www.ato.gov.au/General/JobKeeper-Payment/Payment-rates/80-hour-threshold-for-employees/.

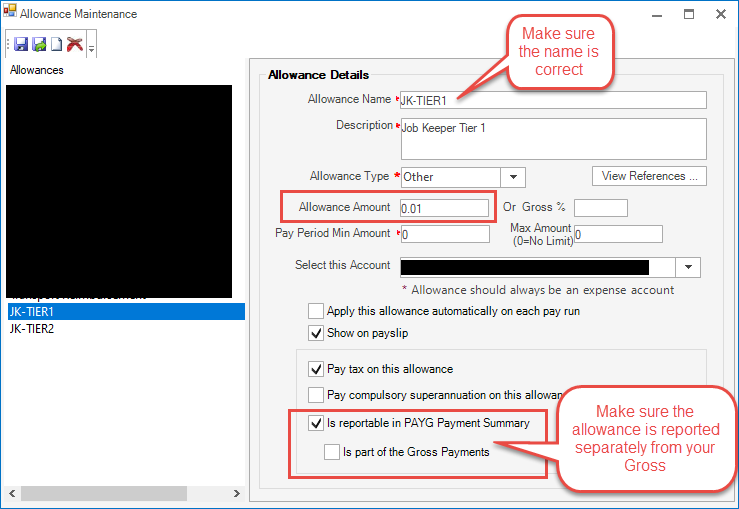

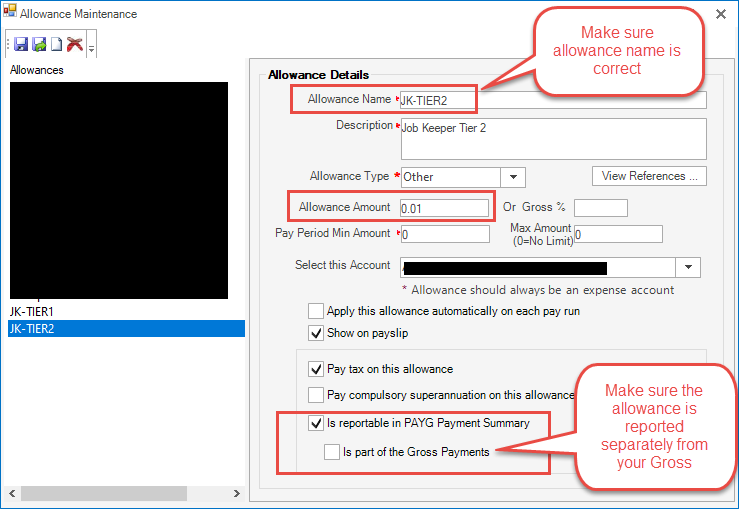

Employers may use STP to report the Tier level to which they have assessed and assigned eligible employees. The Tier level must be reported as Other Allowances using the specific text descriptions only:

- JK-TIER1 – for those employees who worked 80 hours or more in any reference period.

- In Quarter 3, they must be paid at least $1,200 per JobKeeper fortnight.

- In Quarter 4, they must be paid at least $1,000 per JobKeeper fortnight.

- If these employees are paid less than these amounts, a top-up payment must be made to the specified amounts and reported, as per the current reporting arrangements for JobKeeper top-up payments.

- JK-TIER2 - for those employees who worked fewer than 80 hours in any reference period.

- In Quarter 3, they must be paid at least $750 per JobKeeper fortnight.

- In Quarter 4, they must be paid at least $650 per JobKeeper fortnight.

- If these employees are paid less than these amounts, a top-up payment must be made to the specified amounts and reported, as per the current reporting arrangements for JobKeeper top-up payments.

Alternate short forms

Along with the extension of Job Keeper scheme, ATO introduces alternate short forms for allowance name to help software providers who can not use allowance name being too long.

Our Payroll does not have this issue but both forms are now being accepted by ATO when processing STP files.

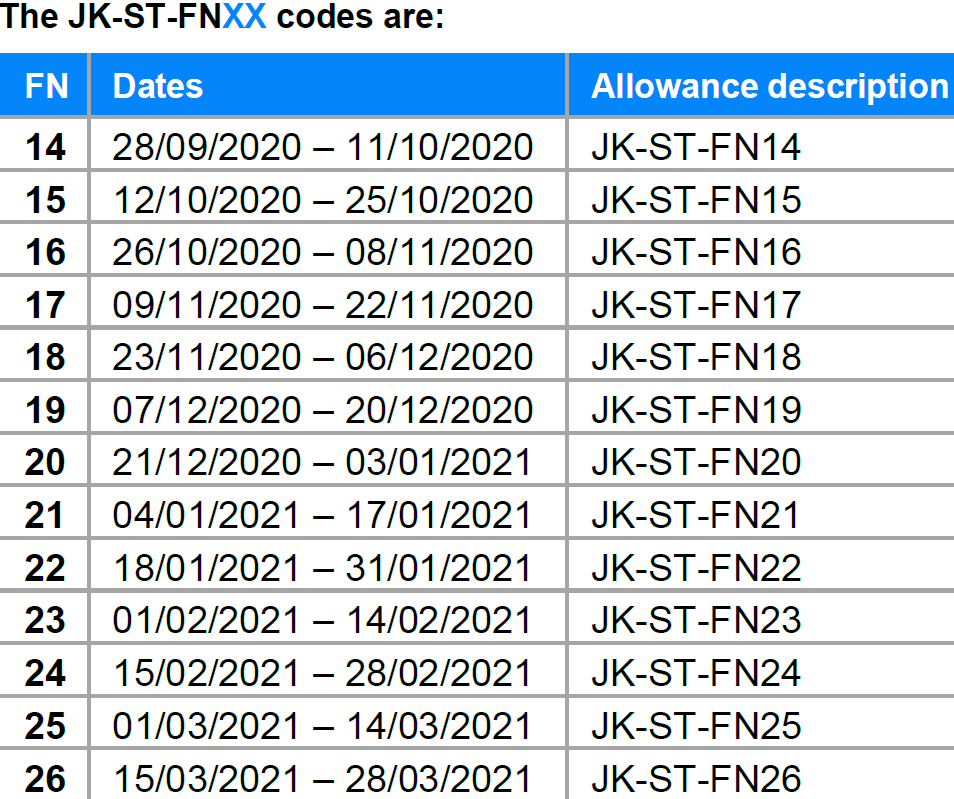

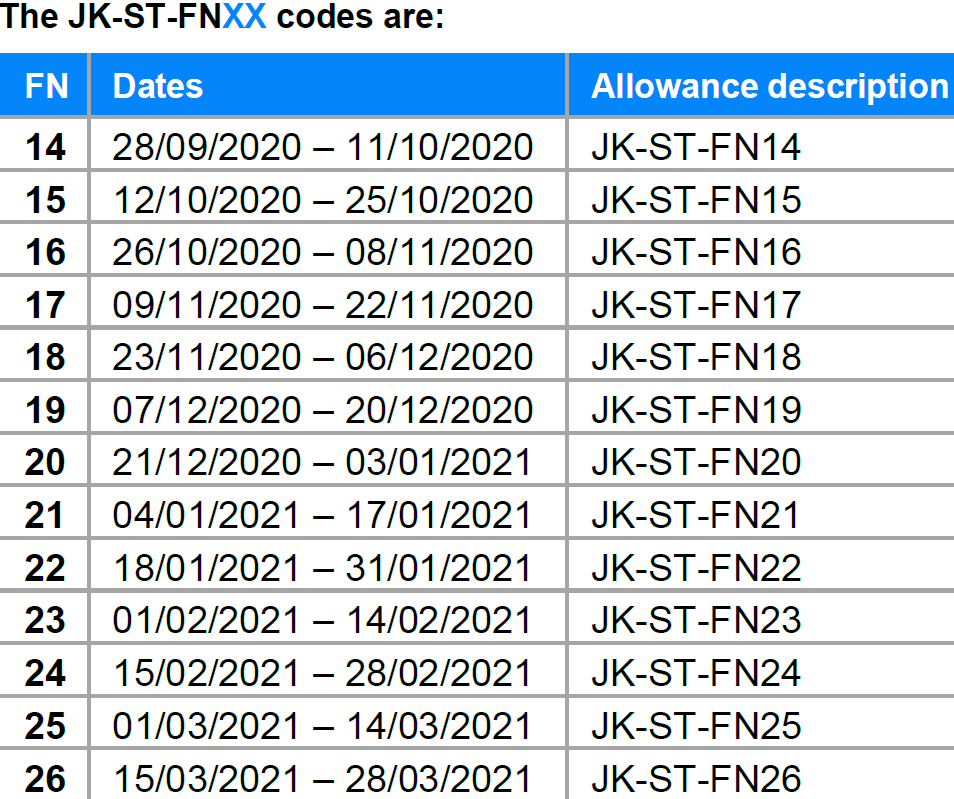

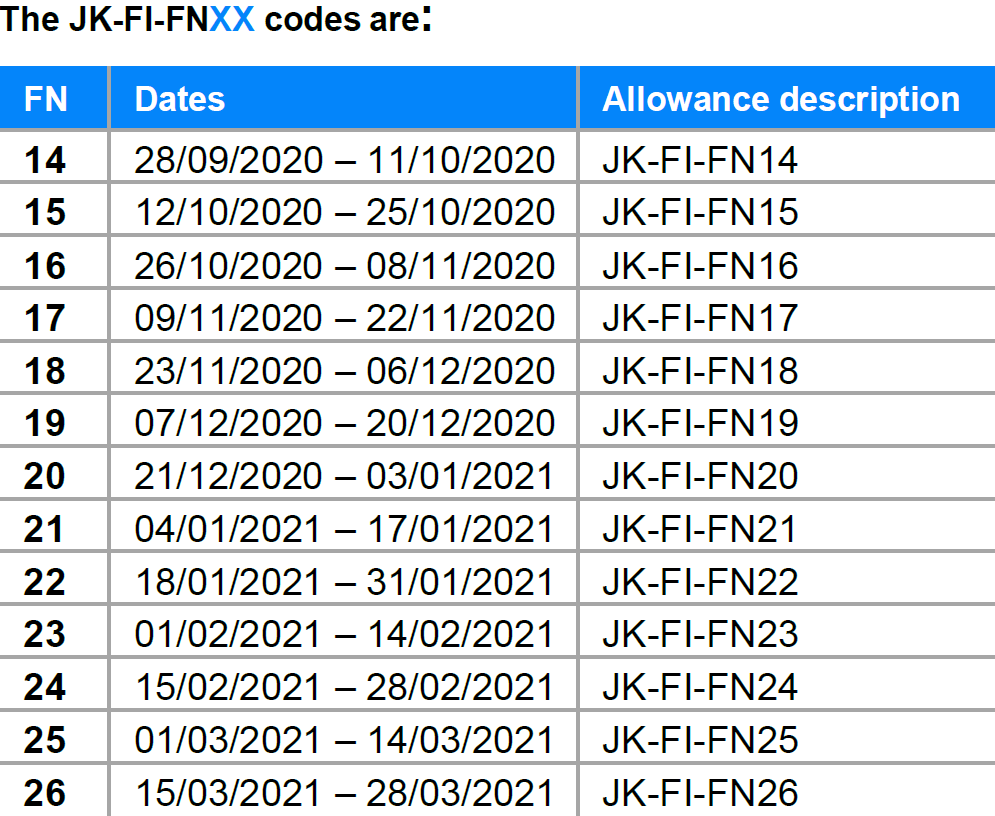

- JOBKEEPER-START-FNxx can be changed to JK-ST-FNxx with "xx" is the fortnight number.

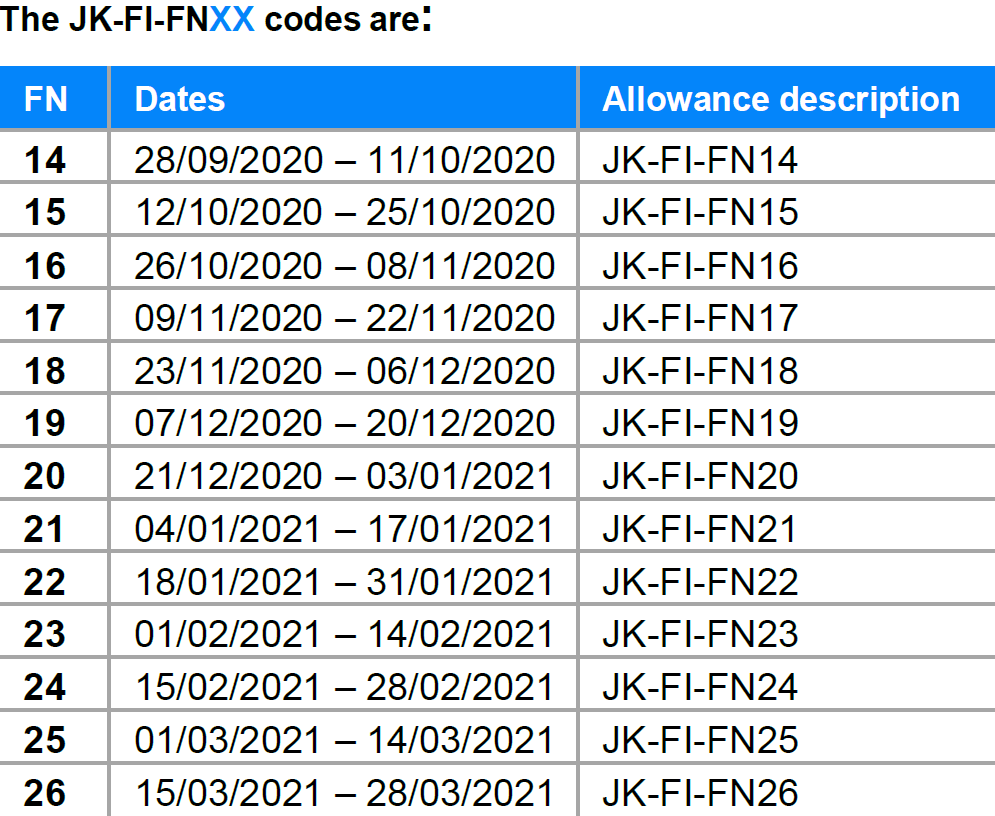

- JOBKEEPER-FINISH-FNxx can be changed to JK-FI-FNxx with "xx" is the fortnight number.

- JOBKEEPER-TOPUP can be changed to JK-TOPUP.

Transition from Job Keeper to Job Keeper 2.0 in Payroll

- If your business is not eligible for Job Keeper 2.0, you don't need to report anything to stop JobKeeper. ATO will assume if you don't start reporting Tier information, JobKeeper is no longer needed.

- If your business is eligible for JobKeeper 2.0 and you have employees who are eligible for JobKeeper, determine which tier level your employees belong to. Click here to view the full instruction on ATO website.

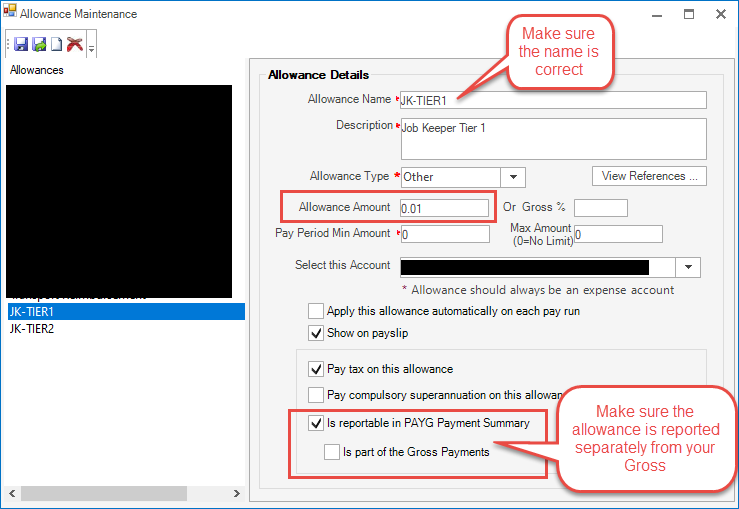

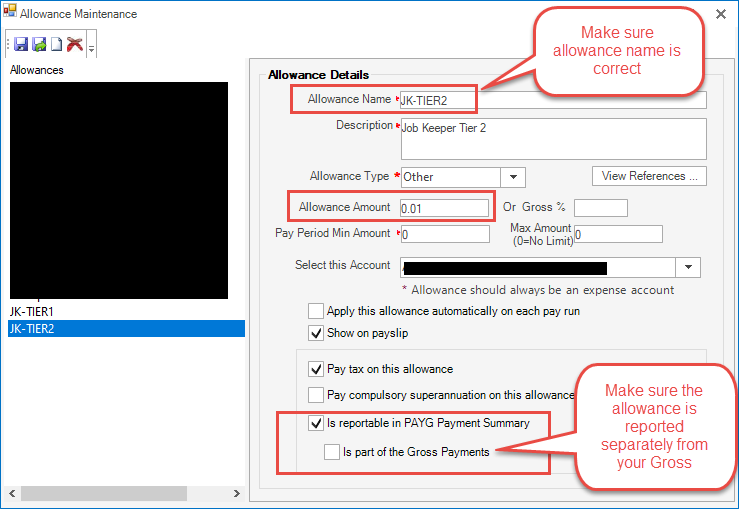

- Here are the proper settings for both tier levels:

- Tier 1 - JK-TIER1

- Tier 2 - JK-TIER2

- Apply one of those tier level allowance and other job keeper allowance (start/finish fortnight and top up if needed) in your employee payrun.

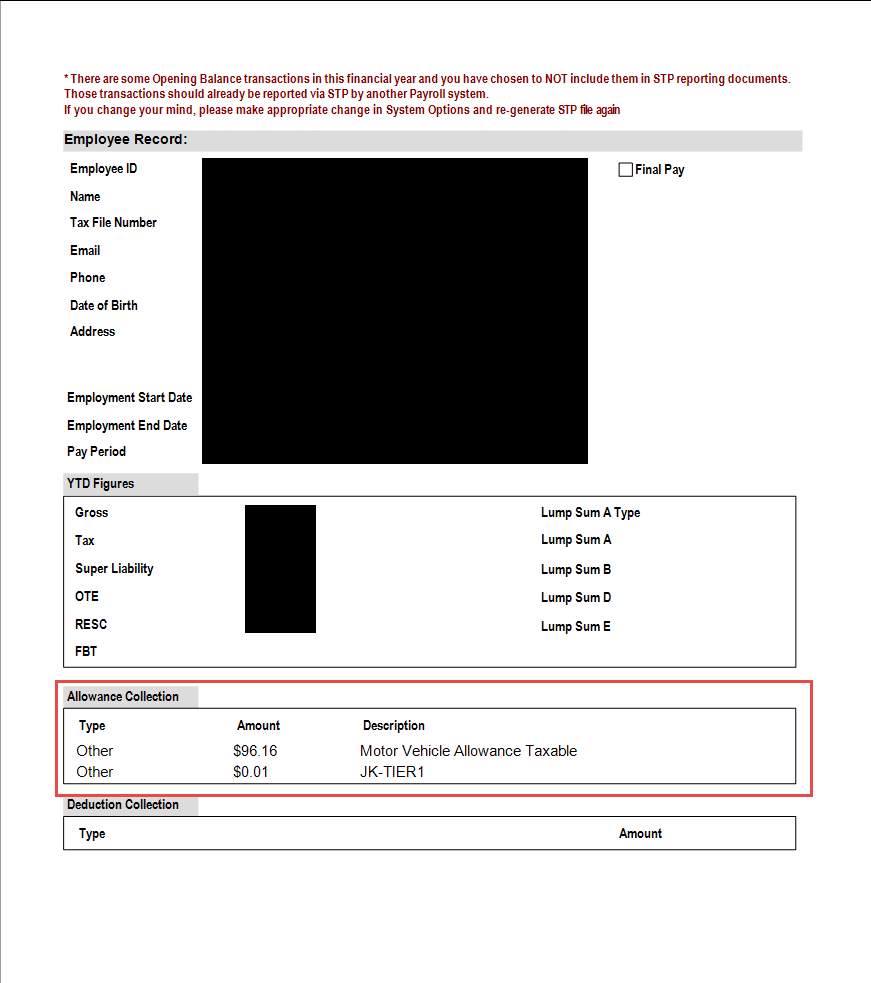

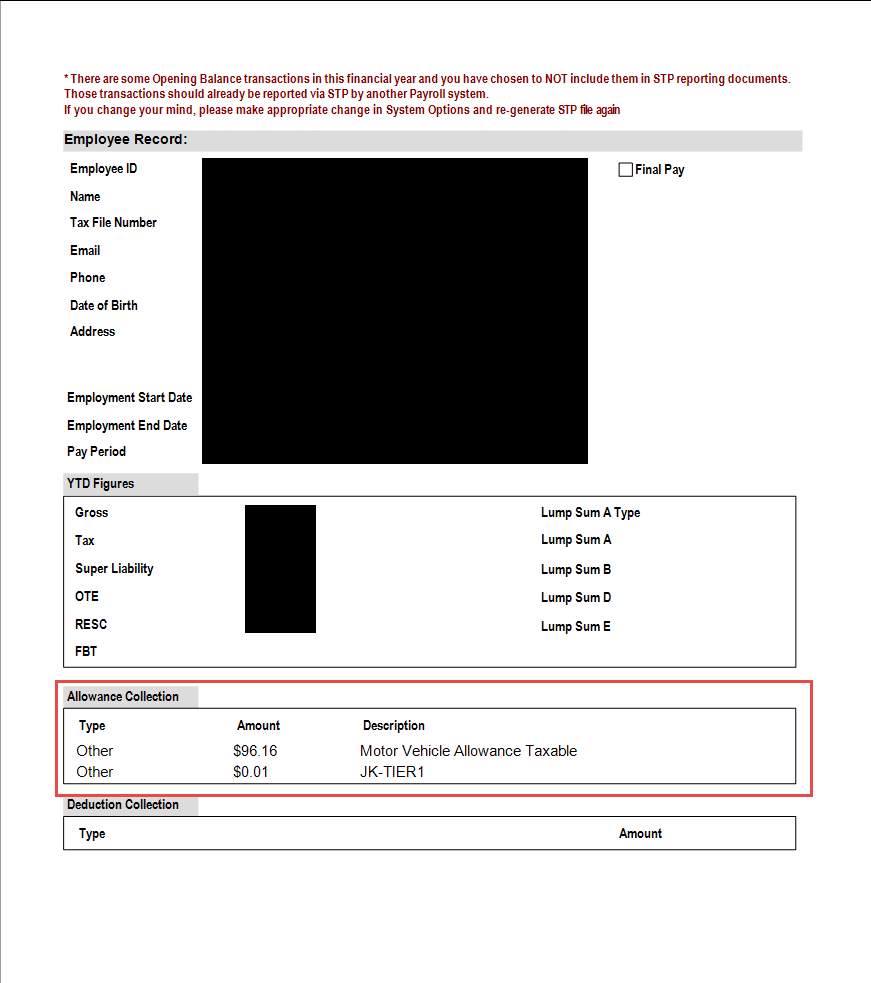

Note: for start/finish fortnight and tier level allowance, you are only required to report once during JobKeeper scheme. No need to apply those allowances in every payrun. - After commited the payrun, check STP file again and make sure those Job Keeper allowances are reported in the right section. Here is the example of STP file snapshot, all Job Keeper allowances should be reported in allowance collection section.

If they are not appeared in the right section, please go back and check your allowance settings.

- Please note that reporting correct tier level is legally binding with ATO so make sure you have the tier level correct for all of your eligible employees.

- In case that you make the wrong choice and report wrong tier level for some employees, please make sure you rectify as soon as possible via STP.

- if that happens in the most recent payrun, you can roll back that payrun and re-enter the correct allowance. Check STP file after to make sure there is only 1 correct tier level reported in allowance section.

- If the error has been made a few payruns back, you can correct the issue in the next payrun by adding a correction allowance:

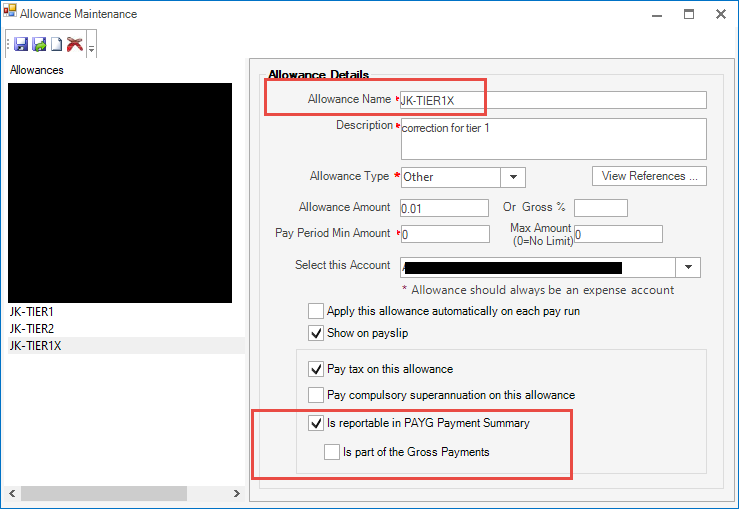

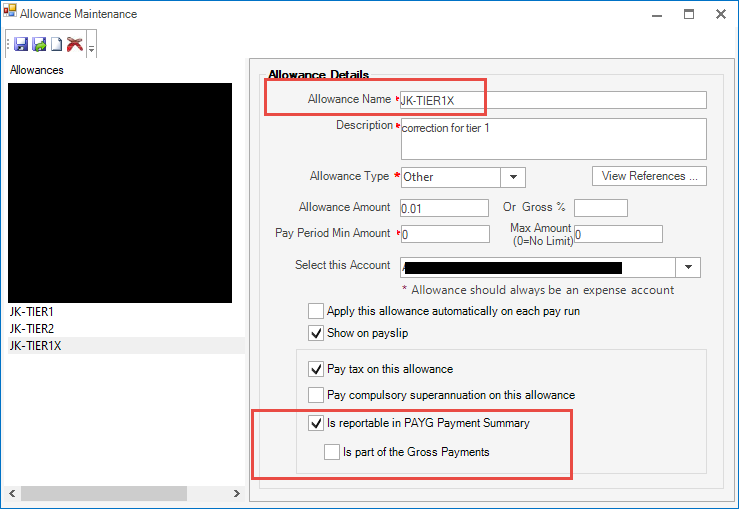

- Add another allowance to the affected employees to correct the wrong tier (JK-TIER1X to cancel tier 1 and JK-TIER2X to cancel tier 2). The settings are the same for both correction allowances and as followed:

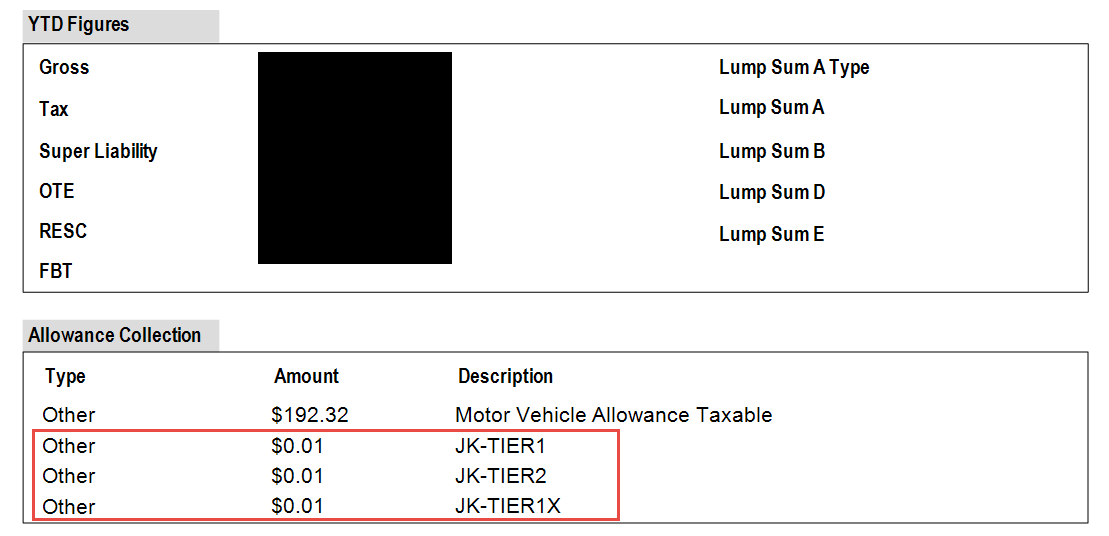

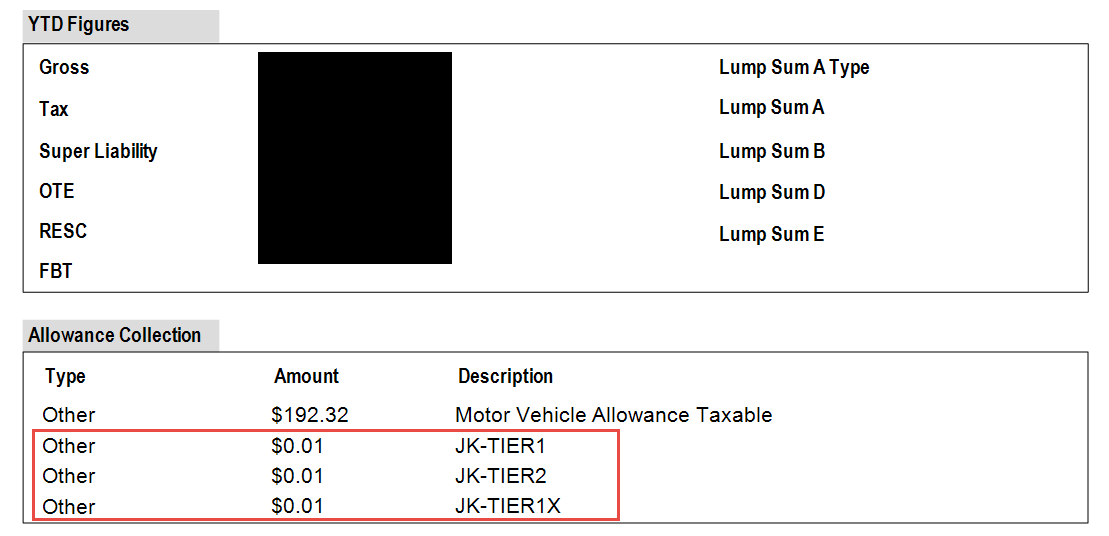

- In the next payrun, apply the correction allowance and the correct tier level allowance. Make sure in the STP file you will see something similar to this:

In this example, this employee will be in tier level 2 for the whole life of JobKeeper 2.0.

- Note: This design does not support multiple corrections, so extreme caution should be taken to ensure accuracy of originally reported JobKeeper extension data. This critical detail is used to determine the reimbursement amount to the employer

JobKeeper Extension Fortnights