Content

Related Issue

Employer guidance

Employers may seek guidance about employer and employee eligibility from the JobKeeper Payment for business website ato.gov.au/jobkeeper.

Employers will have 3 options to notify the ATO of eligible employees:

- Online – Limited to employers with less than 200 employees

- STP – Preferred method for employers using STP (Ultimate support this method using EclipsePayroll).

- File upload – Restricted to employers who are unable to use either of the above (this file may become available in your STP Portal soon)

ATO detailed guidelines for employers using STP

You MUST carefully read this detailed instructions provided by the ATO: JobKeeper and STP instructions.

Notify your eligible employees

You MUST send JobKeeper Employee Nomination Form to all your eligible employees who wish to be part of the payment scheme.

You can download the form here or go to the ATO website about JobKeeper Employee Nomination Notice for more information.

JobKeeper Processing summary

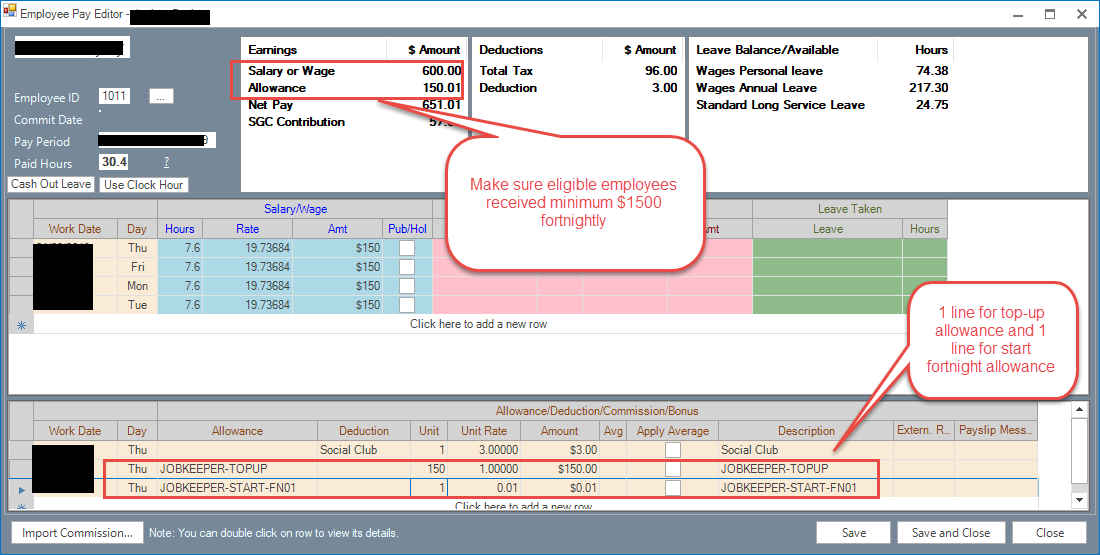

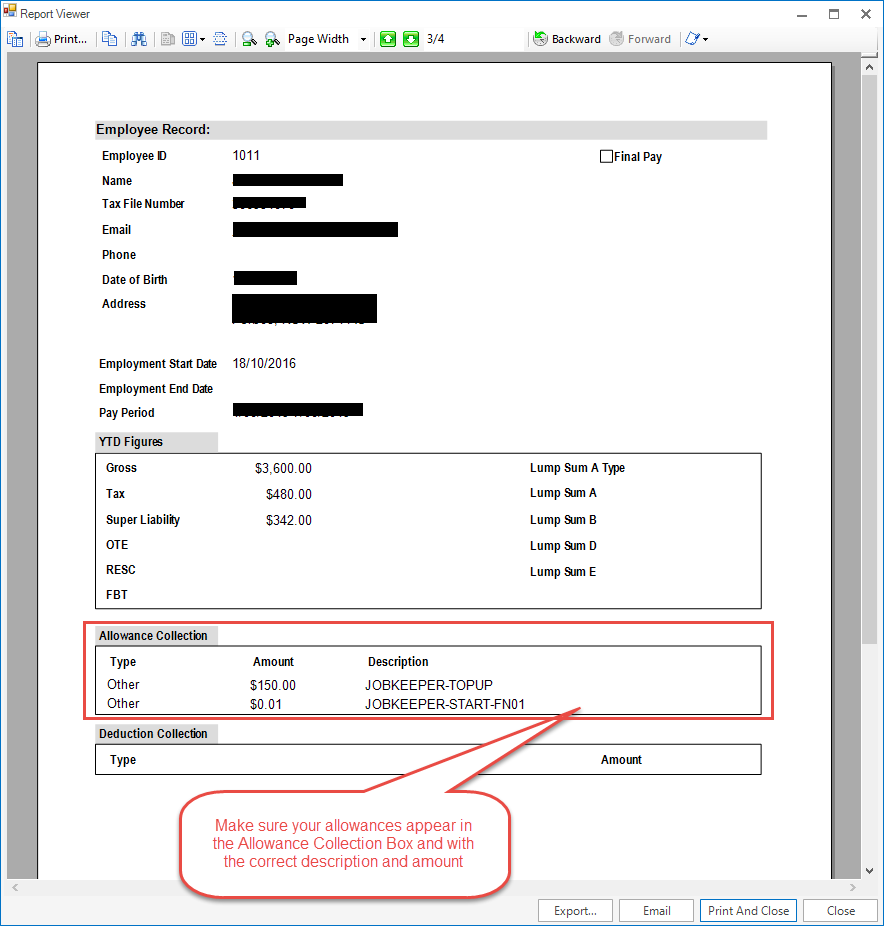

In order for employees to be eligible for JobKeeper, you will need to pay them the minimum of $1500 per fortnight. You will need to pay top-up for employees who earn less than $1500 per fortnight. ATO is using specific allowance codes to track the top-up and start/end of eligibilty for JobKeeper payment. Please view attached guidelines above.

The allowance code "JOBKEEPER-TOPUP" is specifically used for top-up payment so the eligible employees can receive at least $1500 per fortnight as per ATO instruction.

For the period where employees start to become eligible for JobKeeper payment, an allowance of $0.01 with "JOBKEEPER-START-FNxx" is added to employees' payrun to indicate this is the start fortnight.

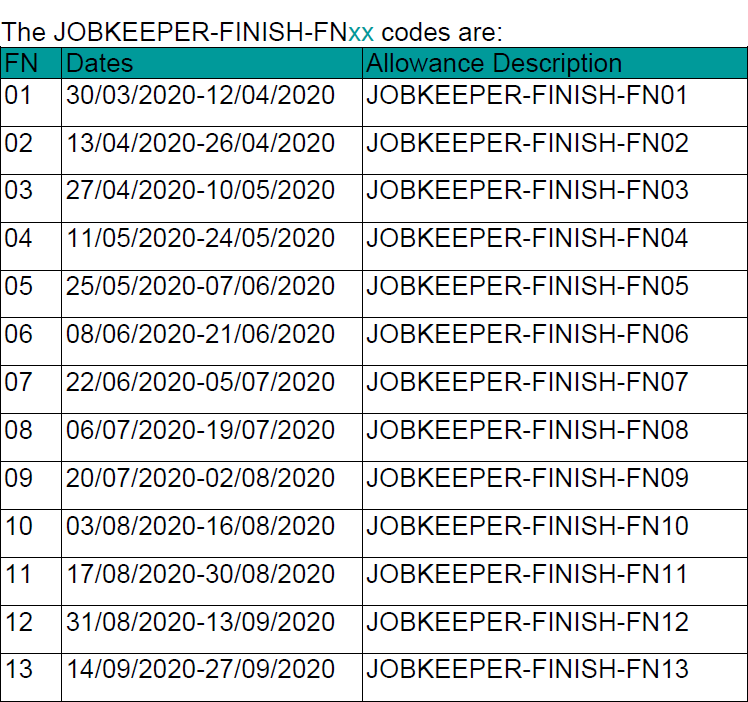

Where employees are no longer eligible for JobKeeper payment, an allowance of $0.01 with "JOBKEEPER-FINISH-FNxx" is added to employees' payrun to indicate this is the finish fortnight. Employees can be eligible and cease to be eligible on multiple occasions.

The allowance names must be in UPPER CASE and exactly match those in the ATO specifications.

Using Ultimate Payroll for JobKeeper reporting

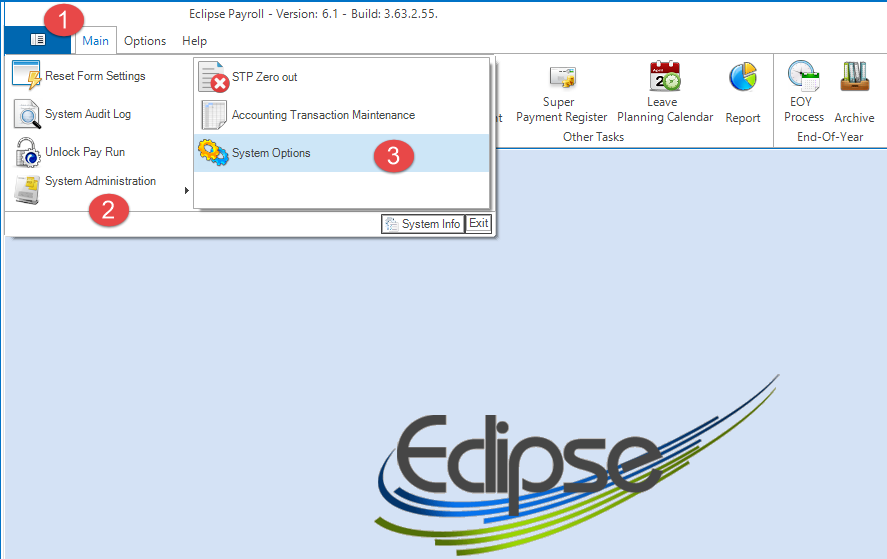

- In order to be able to use Payroll for JobKeeper payment reporting, you will have to enable STP on your Payroll system. If you haven't had STP enabled, please contact UBS support straight away to arrange this (monthly STP fee applies).

- Make a list of employees who are eligible for JobKeeper Payment. For full list of eligible criteria, please visit ATO website. Make sure you collect all the completed JobKeeper Employee Nomination Notice forms.

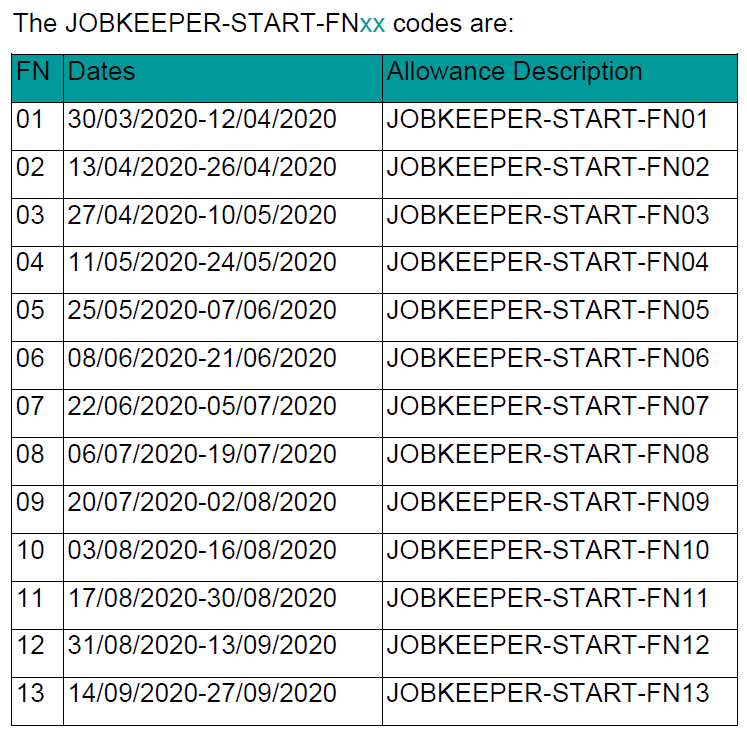

- Determine which fortnight each employee of the above list should start to receive JobKeeper payment. Below is the fortnight code provided by ATO:

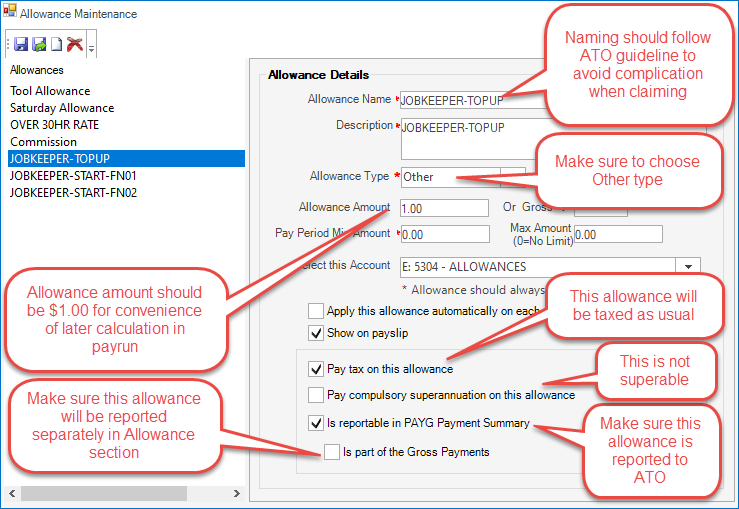

- Create necessary "start allowance" records in Payroll for starting fortnight. 1 allowance record can be used for many employees so you dont have to create one for each fortnight. For example: if all of your employees from the eligible list start claiming from 20/04/2020, you just need to create one allowance record with the name of JOBKEEPER-START-FN02.

Check the figure below for more information: - Please note that those settings will be carried on to employee level but you can always override it in the employee level if you wish to do so.

- Now you will need to review existing payment to eligible employees.

- If you already pay more than $1500 for a fortnight, you dont have to use top-up payment.

- If you pay less than $1500 per fortnight, you will then have to use top-up allowance to get to $1500 fortnightly for each of your employees.

Suggested settings for top-up allowance is in the following figure: - If you want to re-hire employee eventhough there is no work for them, you still need to pay them $1500 fortnightly, but superannuation may not apply to this payment (please check with your accountant).

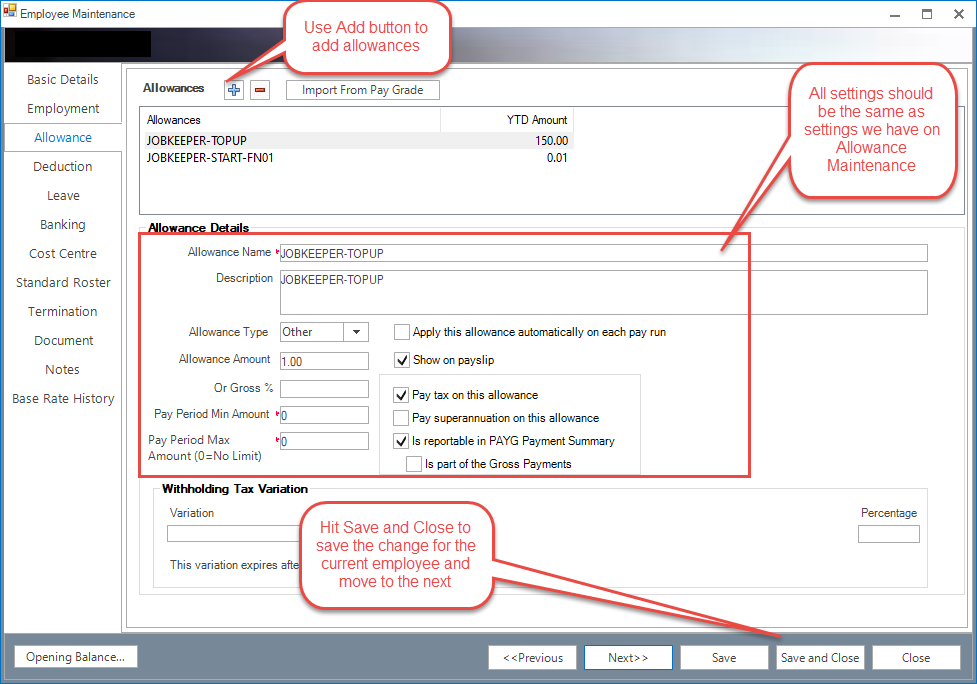

- After you have your allowances in place, you can add those allowances to all eligible employees. You shouldn't need to change any of the settings but in case you wish to change something, you can change it per employee.

- You should be able to start and do your payrun as usual. For eligible employees, you will have to edit their pay and add the "start allowance" and the top-up allowance if needed.

Note: If you choose to apply average on those allowances, it might cause the withholding tax to calculate differently, resulting potential higher tax withhold. - After you commit your payrun, you can go to the Single Touch Payroll sceen to check if your changes have been included in the file. To view the STP document, just double-click on the STP file record.

- ATO require employers to inform them when your employees are no longer eligible for JobKeeper Payment (for complete list of reasons, please visit ATO website). This will be done in the same way that you report when your employees become eligible for the payment.

Here is the ATO guidelines:

You will need to do the same process like when you set up "start allowance". Please make sure you have the allowance names follow ATO rules to avoid any complications in the future.

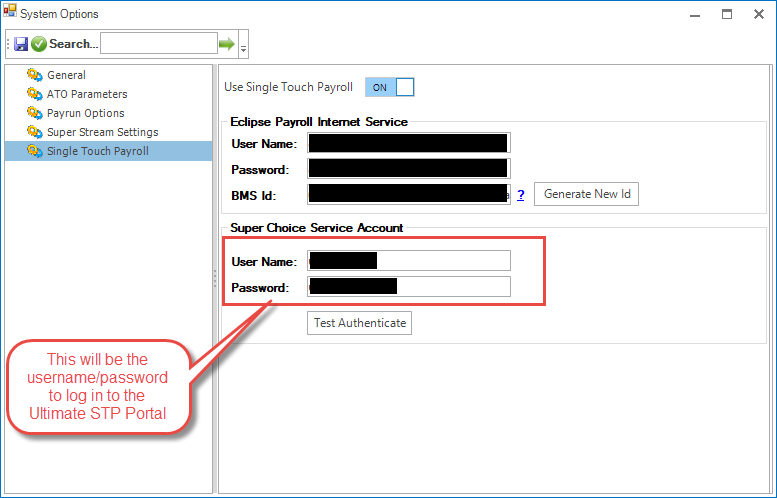

If your employees stay eligible until the completion of JobKeeper payment, you are not required to add allowance "JOBKEEPER-FINISH-FN13". - If you have access to our Ultimate STP Portal, you will be able to view those allowances in your submission files. Simply log in to the portal by clicking here and choose the file you want to double-check then go to "Deductions & Allowances" tab.

- In case that you forgot the details to log in to our portal, you can get these from Ultimate Payroll by go to System Administration → System Options → Single Touch Payroll

Related Issues